ECONOMIC OUTLOOK AND INDICATORS IN GEORGIA

HOTEL PRICE INDEX

PMC RESEARCH - IFO GEORGIAN ECONOMIC CLIMATE

BLACK SEA BULLETIN

QUARTERLY TOURISM UPDATE

ECONOMIC OUTLOOK AND INDICATORS IN UKRAINE

SECTOR SNAPSHOTS

EMPLOYMENT TRACKER

MACRO OVERVIEW

BAG Index

Profile Of Bilateral Relations

Beverage Manufacturing in Georgia

01-May-2025

The beverage manufacturing sector, encompassing the production of fruit juices, mineral water, soft drinks, beer, and spirits, has high export potential and a strong presence of small and medium-sized enterprises (SMEs).

From 2017 to 2023, Georgia’s total beverage exports grew at a CAGR of 10%, reaching USD 463 million in 2023. Despite overall export growth, the share of exports to the EU declined significantly during this time, particularly for SMEs.

Key challenges include limited access to quality raw materials, outdated machinery, a shortage of skilled labor, and logistical constraints, as well as difficulties in meeting EU standards and DCFTA regulations and limited access to financing for export operations.

IT Services in Georgia

10-Apr-2025

Georgia’s IT services sector has experienced rapid expansion, with tax revenues quadrupling between 2020 and 2023, employment increasing 5.4-fold, and turnover rising 13-fold.

Government policies and incentives, such as the International Company Status and FDI Grant Program, have played a key role in attracting foreign investment and driving the sector’s development.

Future growth will rely on strategic initiatives such as the successful implementation of GITA 2.0, enhanced IT procurement policies, and stronger collaboration with the private sector, while addressing key challenges like export capabilities and talent retention.

Hospitality Sector in Georgia

26-Nov-2024

Georgia's hospitality industry benefits from country’s rich cultural and natural attractions. To support the growing interest in these offerings, Georgia has 3,198 registered accommodation providers, though most are smaller-capacity family hotels and guesthouses.

Since 2020, 238 new hotels have opened, and another 324 are planned by 2027, which will increase bed capacity by 130%. While Tbilisi and Adjara see the most growth, rural areas lag behind.

Key challenges include weak long-term planning, high operating costs for smaller businesses, and limited market diversification. For the sector to grow sustainably, the focus must shift to improving infrastructure, diversifying markets, and attracting high-value tourists.

Transportation and Logistics Sector in Georgia

20-Mar-2024

Transportation and logistics sector in Georgia is a vital pillar of the economy, facilitating domestic and international trade. Notably, Georgia's strategic location along the Middle Corridor enhances its significance as a key transit hub connecting Europe and Asia.

In 2023, Georgia's transportation and storage sector experienced moderate growth, with its contribution to GDP increasing by 5.1% despite facing challenges like disruptions in trade with Russia. Although the sector’s share of total gross output declined slightly (-0.8 percentage points, YoY), it remains vital, contributing 6.5% to the national economy's overall output.

Looking ahead, Georgia's transportation and logistics sector is expecting further growth and development. Despite recent challenges, the sector's strategic location along the Middle Corridor presents promising opportunities for expansion. With ongoing efforts to enhance infrastructure and connectivity, Georgia is well-positioned to strengthen its role as a key transit hub between Europe and Asia.

Hazelnut Production Sector in Georgia

30-Nov-2023

Georgia is a significant contributor to the global hazelnut industry, ranking among the world’s leading countries in both shelled and in-shell hazelnut exports.

Nearly all (97.9%) Georgian hazelnuts are produced in the following five regions: Samegrelo (42.2%); Guria (20.7%); Kakheti (12.9%); Adjara (12.0%); and Imereti (10.5%). Among these regions, the price of hazelnuts is highest in Kakheti, followed by Samegrelo and Imereti.

Most of the hazelnuts produced in Georgia are exported. The leading importer countries of Georgian hazelnuts are Italy and Germany.

Honey Production Sector in Georgia

04-May-2023

The global demand for honey is increasing, driven by consumers' growing preference for natural and organic sweeteners over sugar and other health-damaging artificial substitutes and the global honey market is expected to grow from $8.53 billion in 2022 to $12.69 billion by 2029, at a CAGR of 5.83%.

Considering that Georgia is known as the land of the oldest honey discovered, and has suitable natural conditions and biodiversity for high-quality honey production, the development potential for the honey production sector in Georgia is high.

Information and Communications Technology Sector in Georgia

03-Apr-2023

Trends in information and communication technologies (ICT) are shaping the future amid existing global challenges. Among major global ICT trends are the growing prevalence of artificial intelligence (AI) and machine learning (ML), increased mobility, and advanced connectivity.

It is essential for Georgia’s economic development that it keeps pace with these worldwide advances, establishes its own niche, and specializes in certain aspects of ICT. The capabilities of countries to use, adopt, and adapt innovations and digital transformation will play a crucial role in their shaping future economic development. That is why it is crucial to analyse the challenges and opportunities with regard to the development of the ICT sector in Georgia

Wheat And Flour Sector in Georgia

07-Sep-2022

Since the spread of COVID-19 at the end of 2019, the ensuing pandemic has caused an economic crisis impacting global food availability and food security. The effects of the pandemic have been aggravated by the war between Russia and Ukraine, two prominent players in global food and agriculture.

In Georgia, since July 2021, the YoY price increase for both wheat flour and wheat bread has shown a dramatic increase. The YoY price increase for wheat flour reached an all-time maximum of 36.5% in July 2022, while for wheat bread, it peaked in June 2022 at 36.3%.

Finally, considering Georgia’s high dependence on imports from Russia and low self-sufficiency in terms of domestic wheat production, it is crucial that the dialogue between potential trade partners, such as Kazakhstan and Turkey, be intensified in the long run to diversify the wheat market and ensure food security for Georgia.

Construction Sector in Georgia

30-Jun-2022

In this issue, we overview major economic indicators in the construction sector, construction permits, commercial bank mortgage loans for real estate purchases, and construction-related price indices. In addition to that, the results of the BAG business index survey regarding the sales, sales prices, employment, and factors hindering business activity in the construction sector are also provided.

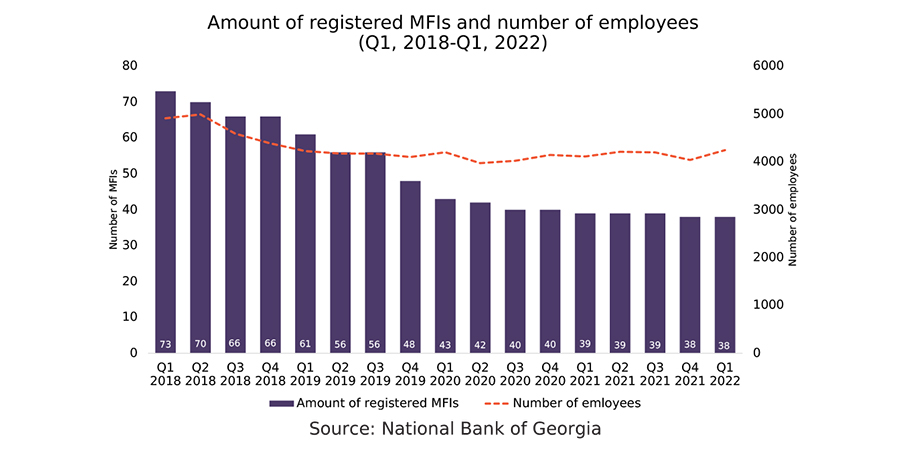

Microfinance Sector in Georgia (2018-Q1 2022)

10-May-2022

Financial institutions play a pivotal role in the development of the Georgian economy. Indeed, while the financial system remains dominated by commercial banks, microfinance institutions (MFIs) are the biggest non-bank lending institutions based on portfolio volume.

The PMC RC periodically publishes sector snapshots on state of MFI sector in Georgia and in this bulletin the state of sector during the period of 2018-Q1 2022 will be overviewed.

- Periodic Issues

- ECONOMIC OUTLOOK AND INDICATORS IN GEORGIA

- HOTEL PRICE INDEX

- PMC RESEARCH - IFO GEORGIAN ECONOMIC CLIMATE

- BLACK SEA BULLETIN

- QUARTERLY TOURISM UPDATE

- ECONOMIC OUTLOOK AND INDICATORS IN UKRAINE

- SECTOR SNAPSHOTS

- EMPLOYMENT TRACKER

- MACRO OVERVIEW

- BAG Index

- Profile Of Bilateral Relations