ECONOMIC OUTLOOK AND INDICATORS IN GEORGIA

HOTEL PRICE INDEX

PMC RESEARCH - IFO GEORGIAN ECONOMIC CLIMATE

BLACK SEA BULLETIN

QUARTERLY TOURISM UPDATE

ECONOMIC OUTLOOK AND INDICATORS IN UKRAINE

SECTOR SNAPSHOTS

EMPLOYMENT TRACKER

MACRO OVERVIEW

BAG Index

Profile Of Bilateral Relations

Monthly Tourism Update (November, 2021)

16-Dec-2021

The number of international travelers increased by 288.8% in November 2021, compared to the same period of 2020, and declined by 73.0% compared to the same period in 2019. Meanwhile, the number of international visitors increased by 267.2% (2021/2020) and declined by 69.3% (2021/2019), and the number of international tourists increased by 283.2% (2021/2020) and declined by 55.3% (2021/2019).

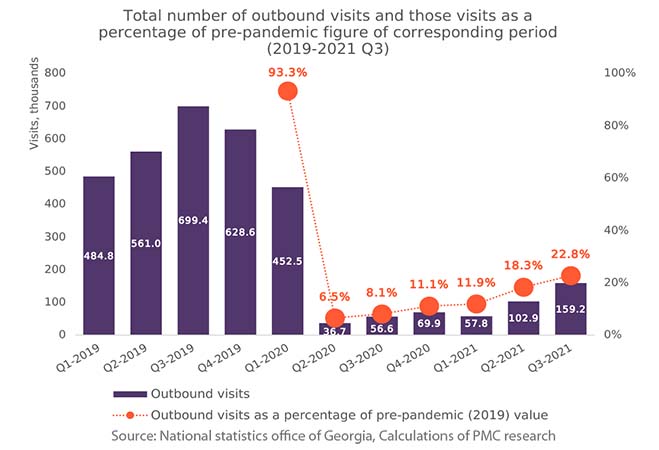

Observing the total number of outbound tourism trips taken by Georgians in 2019 and the pandemic-dominated years since shows that from the beginning of 2021, the demand for international travel among Georgians has demonstrated significant recovery trends, the total number of outbound visits reaching 22.6% of pre-pandemic value in Q3 of 2021, due to vaccination rollout and the easing of entry restrictions in many countries.

An evaluation of the common characteristics of Georgian outbound visits shows that the outbound tourism industry is fairly concentrated in terms of the purpose of visit (top 3 purposes amounting 82.4% of total outbound visits) and visited countries (top 4 destinations accounting for 82.9% of total visits), meaning that the alleviation of entry restrictions to such countries positively affects the number of Georgians taking trips abroad.

Monthly Tourism Update (October, 2021)

18-Nov-2021

The number of international travelers increased by 324.3% in October 2021, compared to the same period of 2020, and declined by 71.8% compared to the same period in 2019. Meanwhile, the number of international visitors increased by 313.7% (2021/2020) and declined by 69.1% (2021/2019), and the number of international tourists increased by 331.5% (2021/2020) and declined by 57.0% (2021/2019).

An observation of the total number of domestic tourism visits in Georgia in 2019 and then throughout the pandemic revealed that since the end of 2020 the numbers surpassed pre-pandemic levels significantly.

The total expenses of domestic visitors in Q2 2021 reached GEL 610 million, which is 70.7% higher than in the corresponding period of 2019, and 128.1% higher compared to Q2 2020.

Monthly Tourism Update (September, 2021)

22-Oct-2021

The number of international travelers increased by 362.5% in September 2021, compared to the same period of 2020, and declined by 73.1% compared to the same period in 2019. Meanwhile, the number of international visitors increased by 348.8% (2021/2020) and declined by 71.1% (2021/2019), and the number of international tourists increased by 401.3% (2021/2020) and declined by 61.1% (2021/2019);

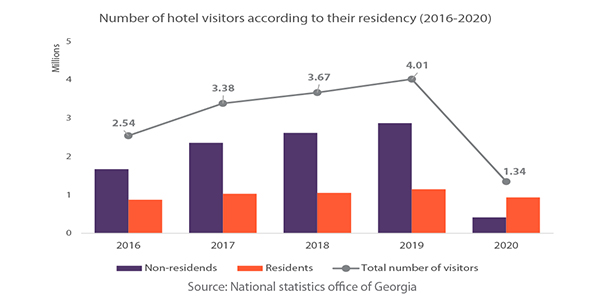

The hotel industry of Georgia had been growing steadily before the pandemic struck, with a significant increase in the number of hotels and considerable growth in the number of people employed in the sector. In 2020, the previously positive trends in major industry indicators reversed which had a large economic impact, causing a 37.3% decrease in the number of hotels operating in Georgia;

During the first year of the pandemic, the role of Georgian residents in tourism increased significantly as they made up 69.4% of total visitors, while the share of hotel visits for medical reasons peaked over the period of 2016-2020 largely due to the utilization of hotels as quarantine zones.

Monthly Tourism Update (August, 2021)

20-Sep-2021

The number of international travelers increased by 538.3% in August 2021, compared to the same period of 2020, and declined by 77.3% compared to the same period in 2019. Meanwhile, the number of international visitors increased by 510.5% (2021/2020) and declined by 75.5% (2021/2019), and the number of international tourists increased by 615.2% (2021/2020) and declined by 67.2% (2021/2019);

Tourists coming to Georgia have customarily originated from a small concentrated selection of countries. Specifically, in 2019, 71.4% of all international visitors to Georgia came from its four neighboring countries. However, in August 2021, the corresponding proportion amounted to just 40.8%, mostly due to an increase in the number of visits from Ukraine, Saudi Arabia, Belarus, and Kazakhstan;

Targeting tourism markets with potential for expansion could be a fruitful approach in Georgia’s economic recovery as the pandemic eventually subsides. In particular, China, with an average growth rate in its number of visitors to Georgia of 54% over 2015-2019, and Kazakhstan, with a corresponding indicator at 36%, stand out as promising markets.

Monthly Tourism Update (July, 2021)

17-Aug-2021

After a challenging 2020 and early 2021 for the tourism sector, various positive developments, such as the alleviation of restrictions, were seen in the tourism sector in Georgia in the second quarter of 2021. As of July 2021, there are no restrictions of movement in place within Georgia, and both land and air borders are open for eligible visitors. Below is a timeline of the relaxing of various COVID-19 measures in the second quarter of 2021:

Since May 17, the curfew was moved from 21:00 to 23:00.

Since May 22, restaurants have been allowed to operate on weekends in open spaces.

Since June 1, restaurants have been allowed to operate on weekends in both open and closed spaces.

Since June 1, land borders have been reopened.

On June 14, tourism information centers around the country re-opened.

On June 16, mandatory PCR testing for visitors aged less than 10 was eliminated.

Since July 1, the curfew (23:00 – 04:00) was removed.

Monthly Tourism Update (June, 2021)

12-Jul-2021

The number of international travelers increased by 294.2% in June 2021 compared to the same period of 2020, and declined by 82.1% compared to the same period in 2019. Meanwhile, the number of international visitors increased by 286.8% (2021/2020) and declined by 79.8% (2021/2019), and the number of international tourists increased by 361.6% (2021/2020) and declined by 71.7% (2021/2019);

In June 2021, the number of visitors from Israel, Ukraine and Kazakhstan recovered to approximately 75% of their June 2019 levels;

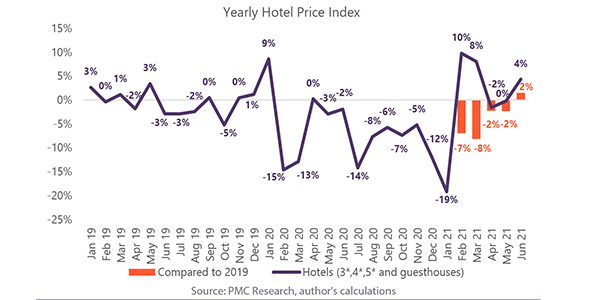

During the period of 2018-2021, average hotel prices in Georgia peaked in 2018, gradually falling in 2019 before plummeting in 2020;

Prices of 5-star hotels experienced the highest volatility, while the prices of guesthouses were most stable;

In June 2021, the Hotel Price Index increased by 1.5% compared to the corresponding month of 2019, mainly driven by positive expectations about tourism’s recovery, as well as the low base effect due to the shock (Russian flight ban) in June 2019.

Monthly Tourism Update (May, 2021)

31-May-2021

The number of international travelers increased by 141.6% in April 2021 compared to the same period of 2020, and declined by 86.8% compared to the same period in 2019. Meanwhile, the number of international visitors increased by 140.4% (2021/2020) and declined by 85.0% (2021/2019), and the number of international tourists increased by 182.2% (2021/2020) and declined by 78.2% (2021/2019);

The number of visitors to Georgia from Israel in April 2021 recovered to 70% of its April 2019 level, with its share in total visitors amounting to 12.2%;

Georgia’s four neighboring countries accounted for 71% of total visitors in 2019. None of these countries had vaccinated more than 20% of their population as of May 23, 2021;

Some countries that stand out for their high vaccination rates among Georgia's key source markets include Israel (63% of the population), United Arab Emirates (61%), the United Kingdom (56%), Hungary (52%), the United States (49%), and Finland (41%). Most EU countries have a rate of around 30-40%;

In April 2021, the Hotel Price Index decreased by 2.3% compared to the corresponding month of 2019, mainly driven by a price decline of 27.4% in Adjara.

Monthly Tourism Update (April, 2021)

06-May-2021

The number of international travelers increased by 141.6% in April 2021 compared to the same period of 2020, and declined by 86.8% compared to the same period in 2019. Meanwhile, the number of international visitors increased by 140.4% (2021/2020) and declined by 85.0% (2021/2019), and the number of international tourists increased by 182.2% (2021/2020) and declined by 78.2% (2021/2019);

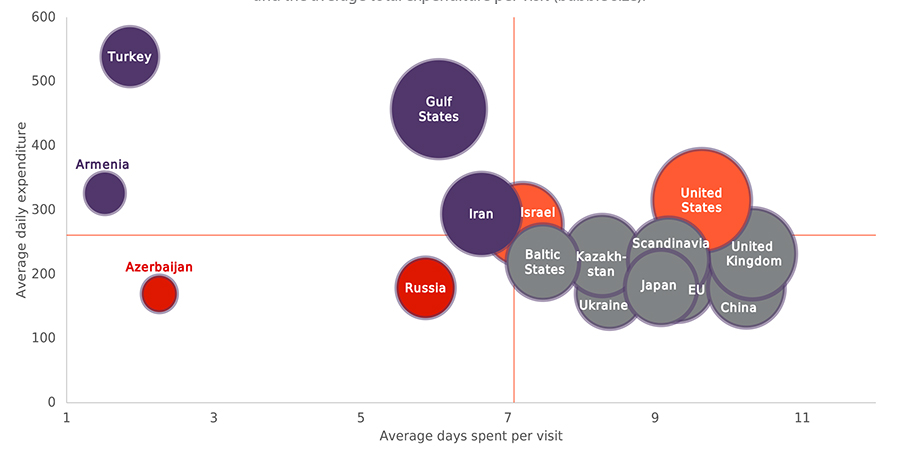

Visitors from the United States and Israel stand out as high-spenders and long-stayers in Georgia, while visitors from Turkey, the Gulf States, Iran, and Armenia have been categorized as high-spenders but short-stayers. Visitors from Russia and Azerbaijan fall into the low-spend, short-stay category;

Israel and the Gulf States accounted for the highest estimated revenue loss in 2020 due to the COVID-19, apart from immediate neighbors. Now, Israel and the United Arab Emirates have one of the highest percentage of vaccinated population, so visitors from the two countries could be worth targeting;

For 2021, it is recommended to channel marketing campaigns toward high-spenders and short-stayers, along with high-spenders and long-stayers;

Due to the abnormal impact of the pandemic on 2020 prices, we use 2019 as the comparison year for the Hotel Price Index for the rest of 2021.

Monthly Tourism Update (March, 2021)

15-Apr-2021

The number of international travelers declined by 75.3% in March compared to the same period of 2020, and by 90.7% compared to the same period in 2019. Meanwhile, the number of international visitors fell by 73.4% (2021/2020) and by 89.0% (2021/2019), and the number of international tourists fell by 64.4% (2021/2020) and by 84.4% (2021/2019);

Saudi Arabia, the United States, Qatar, United Arab Emirates (UAE), and the United Kingdom rank as the top five countries of origin when it comes to highest average expenditure per visit;

Turkey, Saudi Arabia, Qatar, UAE, and Armenia rank as the top five countries of origin when it comes to average expenditure per day;

Targeting visitors from Turkey, via both air and land routes, could be an effective marketing strategy, at least in the short term;

Due to the abnormal impact of the pandemic on 2020 prices, we use 2019 as the comparison year for the Hotel Price Index for the rest of 2021.

Monthly Tourism Update (February, 2021)

16-Mar-2021

The number of international travelers declined by 91% in February compared to the same period of both, 2020 and 2019, while the number of international visitors fell by 90% and the number of international tourists fell by 86%;

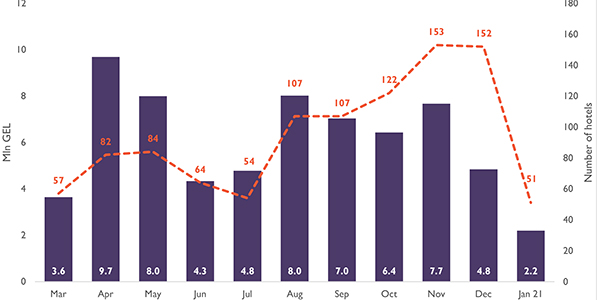

From March 2020 to February 19, 2021, 220 different hotels, and 11 744 hotel rooms, were utilized under the quarantine zones program. A total of 148 904 people stayed in these quarantine hotels over the covered period, and 3 644 people maintained their jobs in these hotels due to the program;

From March 2020 up to and including January 2021, a total of GEL 66.6 mln was spent under the program, averaging GEL 6.1 mln per month. On average, 94 hotels and 6340 hotel rooms were utilized per month, and 32 GEL was spent per hotel room per day.

- Periodic Issues

- ECONOMIC OUTLOOK AND INDICATORS IN GEORGIA

- HOTEL PRICE INDEX

- PMC RESEARCH - IFO GEORGIAN ECONOMIC CLIMATE

- BLACK SEA BULLETIN

- QUARTERLY TOURISM UPDATE

- ECONOMIC OUTLOOK AND INDICATORS IN UKRAINE

- SECTOR SNAPSHOTS

- EMPLOYMENT TRACKER

- MACRO OVERVIEW

- BAG Index

- Profile Of Bilateral Relations